A brand new research from Angi examined totally different residence renovations that repay by boosting your property worth. (iStock)

Dwelling renovations can add worth to your private home whereas additionally making it a greater place to reside, and a few enhancements usually tend to repay when it comes time to promote. A current research from Angi (previously Angie’s Checklist) shared what it stated are the highest residence options that increase a property’s worth, from intricate function updates to intensive residence enchancment initiatives.

“Spruce up your private home together with your dream options, and you might increase its eventual sale worth by greater than the options price,” the article stated.

Probably the most value-boosting function throughout all U.S. housing markets was the pot filler, a kitchen sink attachment situated over your cooktop that makes it simpler so as to add water whereas cooking. Angi estimated that putting in this fixture might price between $600 to $2,000 — however that it pays off with a 3.20% worth premium.

Different options coveted by in the present day’s homebuyers that repay in increased property values embrace:

- Pendant lighting (2.66%)

- Below cupboard lighting (2.48%)

- His-and-hers sinks (2.35%)

- Barn doorways (2.32%)

- Butcher block (2.26%)

- Quartz counter tops (2.26%)

- Outsized home windows (2.23%)

- Farmhouse sink (2.22%)

- Subway tile (2.13%)

REFINANCING FOR HOME REPAIRS AND IMPROVEMENTS: HOW DOES IT WORK?

Probably the most value-boosting enchancment additionally relies on the place you reside. For instance, Angi stated that householders within the New York space have essentially the most to achieve by putting in a storage (18.47%) — a coveted function in a market the place off-street parking comes at a premium. In San Francisco, identified for its year-round sunny local weather, sellers can add essentially the most worth to their houses by including a pool (11.35%).

Whereas a few of these property options are comparatively low-cost to buy and set up, others require a large upfront funding. For instance, including a storage to your private home prices a median of $27,500, in accordance with HomeAdvisor by Angi, whereas constructing a pool will price you about $32,000 on common.

Luckily, there are a number of methods to finance renovations that permit householders to faucet into their present residence fairness or break their upfront prices into mounted month-to-month installments. Preserve studying to be taught extra about residence enchancment financing, and go to Credible to check charges on borrowing merchandise like unsecured residence enchancment loans and cash-out mortgage refinancing.

THINKING OF REFINANCING YOUR MORTGAGE? HERE’S THE MINIMUM CREDIT SCORE YOU’LL NEED

3 methods to finance residence enhancements

A current research stated that the common American home-owner can achieve almost $200,000 in worth by reworking, however many shoppers may very well be held again by the steep upfront price of residence renovations. Fortunately, there are a number of methods to finance residence enchancment initiatives, together with:

Learn extra about every technique within the sections beneath.

1. Money-out mortgage refinancing

Mortgage refinancing is if you take out a brand new residence mortgage with higher phrases to repay your present mortgage. Money-out refinancing is if you borrow a mortgage that is bigger than your present residence mortgage, successfully permitting you to pocket your private home’s fairness in money which you should utilize to pay for residence enhancements.

The typical home-owner gained greater than $55,000 in residence fairness in 2021, in accordance with a brand new report, which provides some debtors the chance to entry more cash than ever with a cash-out refinance.

Take into account that mortgage refinancing comes with closing prices, that are sometimes between 2% and 5% of the overall mortgage quantity. Plus, mortgage charges have surged shortly in 2022, which implies it is vital to buy round for the bottom price doable in your monetary state of affairs.

You possibly can go to Credible to check mortgage refinance charges throughout a number of lenders directly. That manner, you possibly can relaxation assured that you just’re getting a aggressive price whereas financing residence renovations.

HOW TO AVOID A MORTGAGE PREPAYMENT PENALTY

2. Dwelling fairness loans and HELOCs

One other standard residence enchancment financing choice is a residence fairness mortgage or residence fairness line of credit score (HELOC). It is a separate mortgage along with your first mortgage that permits you to borrow in opposition to the fairness you’ve got constructed in your house.

Whereas residence fairness loans include a hard and fast mortgage quantity and reimbursement phrases, HELOCs mean you can borrow simply what you want from a revolving credit score line. Each borrowing choices are secured loans that use your private home as collateral, which implies the creditor can seize your property in case you fail to repay the mortgage.

Most residence fairness mortgage and HELOC lenders allow you to borrow as much as 85% of your private home’s appraised worth. Like with cash-out mortgage refinancing, some of these loans require the borrower to pay closing prices.

You possibly can be taught extra about calculating your private home fairness on Credible.

PERSONAL LOAN ORIGINATION FEES: ARE THEY WORTH THE COST?

3. Unsecured private loans

Not like different secured mortgage choices for residence enchancment financing, private loans are unsecured and do not require you to make use of your private home as collateral. They mean you can borrow a lump-sum of money that you just repay at a hard and fast rate of interest in predictable month-to-month funds over a set reimbursement interval, sometimes a couple of years.

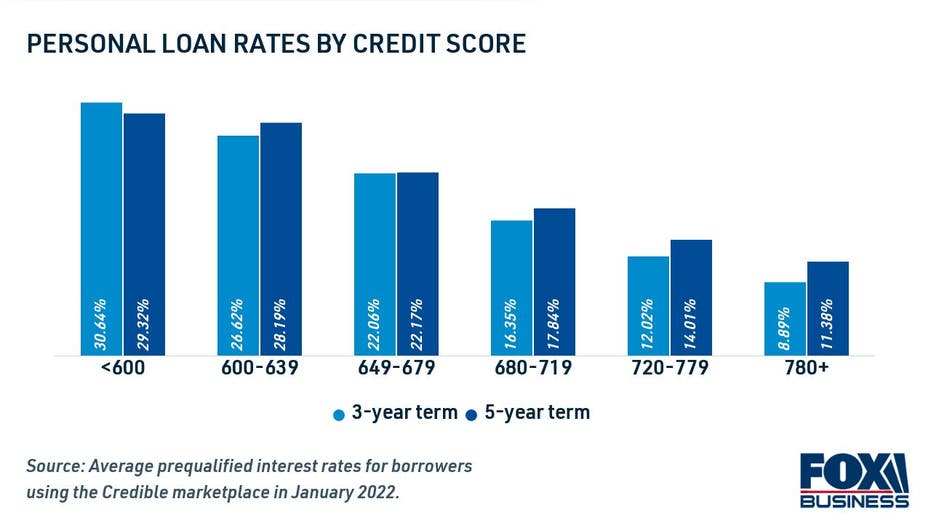

Since private loans are unsecured, lenders decide eligibility and mortgage phrases primarily based on a borrower’s credit score historical past. Candidates with good credit score and a low debt-to-income ratio (DTI) will qualify for the bottom charges accessible, whereas these with honest or unfavorable credit ratings may even see increased charges — in the event that they qualify in any respect.

GETTING A SECOND MORTGAGE? HERE’S WHAT YOU NEED TO KNOW

One other profit to utilizing a private mortgage for residence enchancment is that lenders provide quick funding. The mortgage quantity could also be deposited straight into your checking account as quickly as the following enterprise day after mortgage approval. That is in distinction to residence fairness choices, which require an extended closing interval. Plus, short-term private mortgage charges are at present close to historic lows, in accordance with information from Credible.

You possibly can browse present private mortgage rates of interest within the desk beneath. And you’ll go to Credible to get prequalified by means of a number of on-line lenders directly at no cost with out impacting your credit score rating.

VETERANS BORROWING VA LOANS AT A RECORD PACE, STUDY SHOWS

Have a finance-related query, however do not know who to ask? E-mail The Credible Cash Knowledgeable at [email protected] and your query may be answered by Credible in our Cash Knowledgeable column.